YourBoy007

Active Member

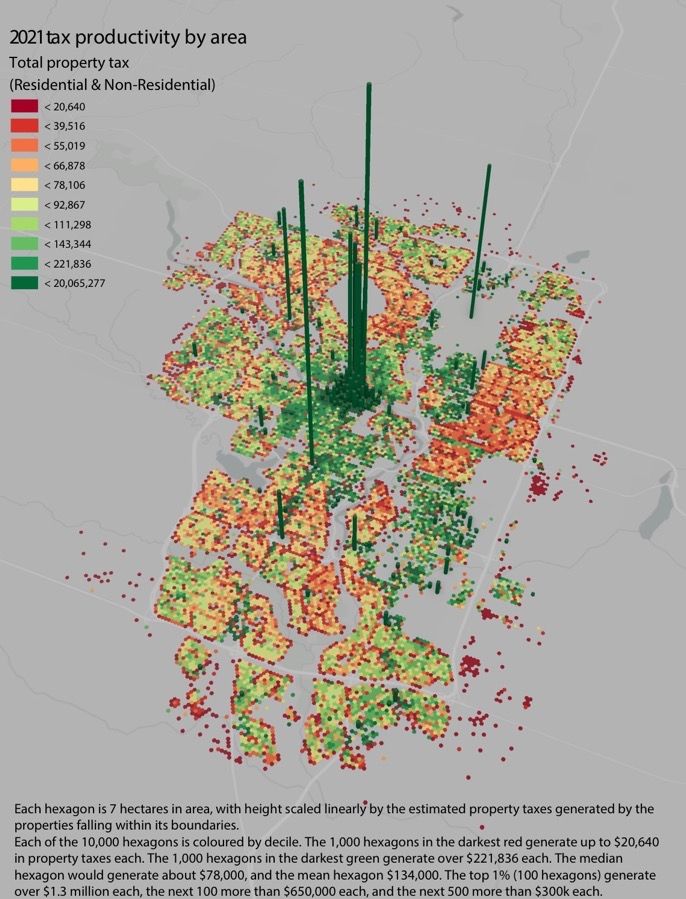

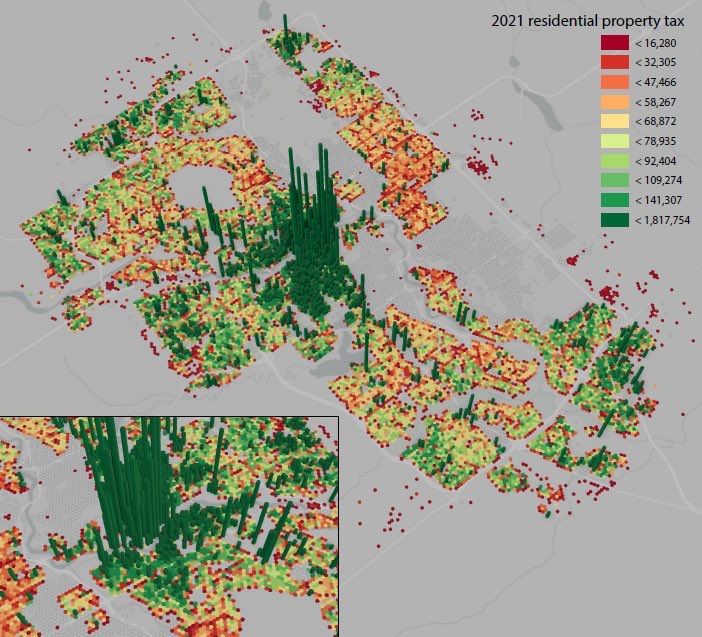

Not sure if these numbers were posted yet but this definitely shows Calgary's urban sprawl problem.

That is cool as hell. Here's my attempt at estimating the share of tax revenue from each of the 10 colour groups of hexagons (based on the legend and text).Not sure if these numbers were posted yet but this definitely shows Calgary's urban sprawl problem.

View attachment 450086View attachment 450087

Do you have a link you could share, as I would love to zoom in on certain sections.Not sure if these numbers were posted yet but this definitely shows Calgary's urban sprawl problem.

View attachment 450086View attachment 450087

It looks like a lot of the newer, post MDP greenfield communities are actually doing pretty decent. Lots of green around the edge. It is the "inner ring" of roughly 70's-00's communities that are mostly red/yellow. This aligns with the recent analysis for the new community business cases in Summer '22 that showed the 5 approved communities as being revenue positive in very short order.Not sure if these numbers were posted yet but this definitely shows Calgary's urban sprawl problem.

View attachment 450086View attachment 450087

And density feeds into that. Land value vs building value.Isn't this just a function of property values?

I'd say it's more correlated with density. Housing in 60-70s suburbs like Canyon Meadows, Willow Park, Glendale Thorncliffe etc. is very desirable and consequently much more expensive than in new build communities, yet these areas are still relatively unproductive in terms of property tax revenue due to generous lot sizes.Isn't this just a function of property values? Property values are highest in the gentrified inner city and newly built houses in the suburban edge. They're lowest within the aging suburbs, which are also the most affordable areas (and therefore where the poorest Calgarians live). Presumably the "donut of decline" will continue to move outward as the newer suburbs age and the inner suburbs gentrify. So, while the new suburbs are revenue positive now, they won't be in future generations.

It's not that we are always allocating funding to the wrong areas, it's also that we are allocate funding to the wrong type of thing in the tax efficient areas (e.g. the inner city) to support the areas that are less tax efficient.As an inner city resident, I tend to gripe about how much tax money is allocated to the suburbs relative to the inner city, where collections are substantially higher. I would love to see a user pay model with toll roads installed on all major freeways.

There's a chicken and egg issue here. There's not a lot of densification in the older suburbs because they are poor areas. There's less demand to move there. In fact, most of those areas are actually losing population and becoming less dense.Definitely need to get more development in some of those orange/yellow areas. you can see on the SRC map, that those areas are very thin when it comes to recent developments or new proposals.

Upper mount royal has a population density of 1,955.4 people/km2. Marlborough Park has a density of 3,356.4 people/km2. But look at the difference in residential property tax that is generated:I'd say it's more correlated with density. Housing in 60-70s suburbs like Canyon Meadows, Willow Park, Glendale Thorncliffe etc. is very desirable and consequently much more expensive than in new build communities, yet these areas are still relatively unproductive in terms of property tax revenue due to generous lot sizes.

Upper Mount Royal is restricted to the current density by multiparty perpetual private contracts—a restrictive covenant. They were used as a form of private zoning before modern zoning and HOAs were developed. I think the last neighbourhood to have one was Shawnee Slopes, but that one had a built in expiry. Many of the CPR neighbourhoods have them, even relatively modern ones like Glamorgan iirc.One of my takeaways is that land in Upper Mount Royal is way too valuable to be locked up in unproductive McMansions. Bulldoze the lot of them and build highrise, mixed-use apartment buildings!

It seems to be a few different issues. Some of inner city areas with low density have good opportunity for it, but get a lot of opposition and also have a lack the zoning for it. Two areas I can think of off are Elbow Drive and Northmount Drive. Both traverse almost completely through middle or upper middle class areas, and are on long transit routes that pass by lots of schools and retail, etc, but those roads are made up of mostly single family homes. But I see what you are saying, and it's also true. Looking at the SRC map, one can see there is little momentum on development on pretty much the whole east side of CalgaryThere's a chicken and egg issue here. There's not a lot of densification in the older suburbs because they are poor areas. There's less demand to move there. In fact, most of those areas are actually losing population and becoming less dense.