Not Sure if this if this is news...

Zoolander Corporation

TSX VENTURE: ZOO.P

Aug 15, 2007 17:31 ET

Zoolander Corporation Announces Proposed Qualifying Transaction

TORONTO, ONTARIO--(Marketwire - Aug. 15, 2007) - Zoolander Corporation ("Zoolander") (TSX VENTURE:ZOO.P), a capital pool company, is pleased to announce that it has entered into a letter of intent with Dundee Distillery District Commercial LP and Cityscape Holdings, Inc. (collectively, the "Vendors") to acquire certain assets (collectively, the "Property") commonly referred to as Rackhouse D for the purpose of establishing a boutique hotel in the distillery district of Toronto, Canada (the "Qualifying Transaction"). If completed, the proposed acquisition will constitute Zoolander's qualifying transaction pursuant to the policies of the TSX Venture Exchange (the "Exchange").

Information Concerning Zoolander

Zoolander is a company existing under the laws of Ontario and is a reporting issuer in British Columbia, Alberta and Ontario. Zoolander currently has 13,654,000 common shares (the "Zoolander Shares") outstanding.

Zoolander has granted stock options to acquire up to an aggregate of 1,350,000 Zoolander Shares at a price of $0.10 per share (the "Zoolander Options") to directors, officers and consultants. Zoolander has also issued broker warrants to acquire up to an aggregate of 196,000 Zoolander Shares at a price of $0.10 per share (the "Zoolander Warrants") as part of the compensation payable to the agent in connection with Zoolander's initial public offering. Other than the Zoolander Options and Zoolander Warrants, no other securities, convertible or exchangeable into Zoolander Shares, are outstanding.

Further information concerning Zoolander can be found in the prospectus of Zoolander which is available on the SEDAR website at

www.sedar.com.

Information Concerning the Vendors

Cityscape Holdings, Inc., a private company existing under the laws of Ontario, is a nominee, holding for the benefit of four holding companies which are controlled by Mathew Rosenblatt, John Berman, Jamie Goad and David Jackson, respectively, each of whom is a resident of the Province of Ontario.

Distillery District Commercial LP is a limited partnership governed by the laws of the Province of Ontario.

The general partner of Distillery District Commercial LP is an Ontario corporation wholly-owned by Dundee Realty Corporation. Dundee Realty Corporation is a private company existing under the laws of Ontario that is indirectly controlled by Dundee Corporation, a TSX-listed corporation.

Michael Cooper, the Chief Executive Officer, President and a director of Zoolander, indirectly holds a 21.7% voting interest in Dundee Realty Corporation and is the sole director and officer of Dundee Distillery District (GP) Commercial Inc., the general partner of Distillery District Commercial LP.

Pursuant to the terms of an Amended and Restated co-owner's agreement dated as of February 9, 2006, as amended May 22, 2007 between the Vendors, the Vendors own all of the assets owned and/or used in connection with the Property, including specifically, all fixed assets (including real property) comprising the Property (collectively, "the Assets").

Information Concerning the Proposed Qualifying Transaction

Zoolander and the Vendors have entered into a letter agreement dated as of July 25, 2007 (the "Letter of Intent") setting out certain terms and conditions pursuant to which the proposed Qualifying Transaction will be completed. The Qualifying Transaction is subject to the parties successfully negotiating and entering into a definitive asset purchase agreement, such that the Qualifying Transaction may be completed on a tax preferred basis to the parties thereto.

In accordance with the terms of the Letter of Intent, Zoolander intends to acquire the Assets from the Vendors at an aggregate purchase price of $3,000,000 (the "Acquisition"), which purchase price shall be payable by the issuance of an aggregate of 15,200,000 Zoolander Shares to the Vendors on closing of the Acquisition, being 50% of the issued and outstanding shares of Zoolander on a fully-diluted basis. It is currently contemplated that the Vendors shall each receive 7,600,000 Zoolander Shares in consideration for the Assets. Zoolander and the Vendors will, on the closing of the Acquisition, jointly execute an election, in prescribed form and containing the prescribed information, to have the provisions of subsection 85(1) of the Income Tax Act (Canada) apply to the sale of the Assets by the Vendors to Zoolander, at such elected amounts as determined by the Vendors in their sole discretion. The Vendors shall sell the Assets to Zoolander free and clear of any liens, charges or any other encumbrances and Zoolander will not assume any liabilities of the Vendors in the purchase and sale of the Property. On closing, Zoolander shall also reimburse the Vendors in respect of all development costs incurred by the Vendors since January 1, 2007 in connection with the Property, to a maximum of $12,000.

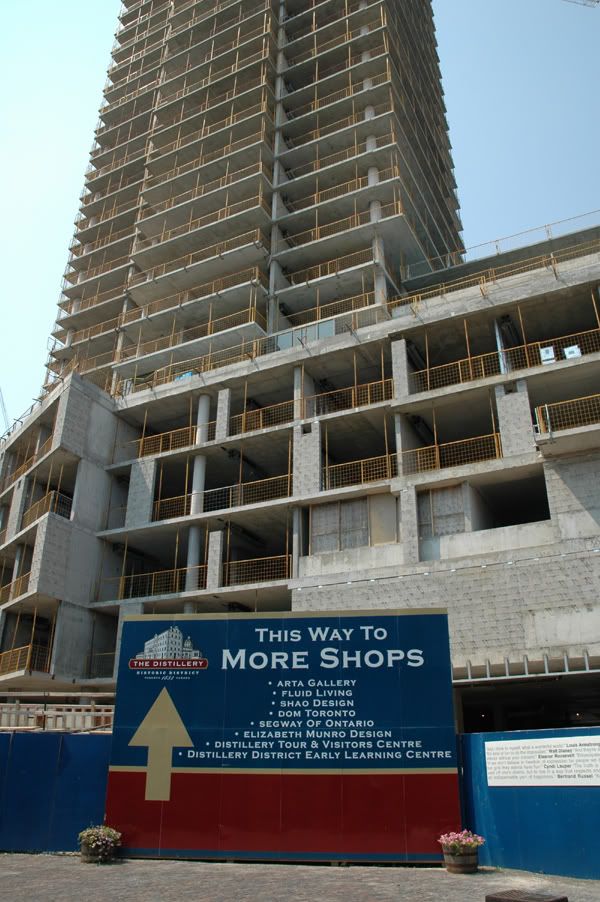

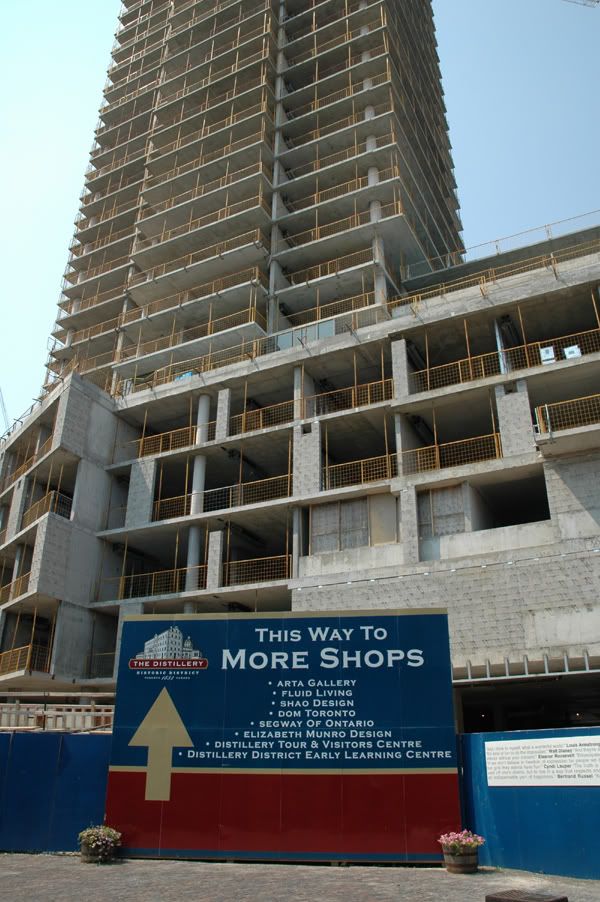

Upon completion of the Acquisition, Zoolander intends on establishing and managing a boutique hotel in Toronto's Distillery Historic District and to be a Tier 2 Real Estate Issuer on the Exchange. The Assets to be acquired are comprised of a single vacant building, approximately 50 feet in height, and an 11,000 square foot floor plate, that was formerly used to store liquor produced at the adjoining Gooderam and Worts distillery. The proposed plan is to redevelop and convert the "Rackhouse D" into a boutique hotel containing approximately 120 rooms.

The proposed Qualifying Transaction will not constitute a "Non Arm's Length Qualifying Transaction" as defined under the CPC Policy and, therefore, does not require shareholder approval. There can be no assurance that the transaction will be completed as proposed or at all.

The backgrounds of all of the directors of Zoolander are contained in the prospectus of Zoolander dated January 31, 2006 which is available on the SEDAR website at

www.sedar.com. No changes to the directors or officers of Zoolander are currently contemplated in connection with the completion of the Qualifying Transaction.

The completion of the Qualifying Transaction is subject to the approval of the Exchange and all other necessary regulatory approvals. It is also subject to additional conditions precedent, including approvals of Zoolander and the Vendors as required under applicable corporate or securities laws, satisfactory completion of due diligence reviews by the parties and certain other conditions customary for transactions of this nature.

Trading on the Zoolander Shares has been halted as required by Exchange policies.

It is the parties' expectation that the closing of the Qualifying Transaction will occur on September 30, 2007 or earlier.

The proposed Qualifying Transaction is subject to the sponsorship requirements of the Exchange. A sponsor will be identified at a later date and will be announced in a subsequent press release of Zoolander. An agreement to sponsor should not be construed as an assurance with respect to the merits of the transaction or the likelihood of completion of the proposed Qualifying Transaction.

As noted above, completion of the Qualifying Transaction is subject to a number of conditions, including, but not limited to, acceptance by the Exchange. The Qualifying Transaction cannot close until the required approvals have been obtained. There can be no assurance that the Qualifying Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement or information circular of Zoolander to be prepared in connection with the proposed Qualifying Transaction, any information released or received with respect to the proposed Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Zoolander should be considered to be highly speculative.

This press release contains projections and forward-looking information that involve various risks and uncertainties regarding future events. Such forward-looking information can include without limitation statements based on current expectations involving a number of risks and uncertainties and are not guarantees of future performance of Zoolander. These risks and uncertainties could cause actual results and Zoolander's plans and objectives to differ materially from those expressed in the forward-looking information. Actual results and future events could differ materially from those anticipated in such information. These and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and expressly qualified in their entirety by this notice. Bradmer assumes no obligation to update forward-looking information should circumstances or management's estimates or opinions change.

The Exchange has in no way passed upon the merits of the proposed Qualifying Transaction and has neither approved nor disapproved the contents of this release.

For more information, please contact

Zoolander Corporation

Orest Zajcew

Chief Financial Officer and Secretary

(416) 488-8825