In that case, it's investing in your low cost housing for retirement don't you think?

Many people view their housing as a very long term investment. It's an investment that you get utility out of, but it's what people use to justify buying more house than they need. I'd imagine a sizeable portion of homeowners in their working years imagine the time where they sell their primary residence and use the equity to downsize to a sleeper community for retirement years.

Well intentioned, non speculators looking for a family home factor in the 'investment' side of owning a home. It's the speculators that ran wild with the market that took it to a crazy level.

Renting tends to be less expensive than a mortgage payment in downtown. I've done the math on various different comparable units, and although it's a tiny cross section of housing, I found that rent is about 70% that of what a mortgage payment would be. Mortgage payments are justified if the value of the home climbs, otherwise, you're better off renting and putting the 30% into investments. If and when we have a housing price contraction, it's smarter to ride the downturn out by renting and saving the difference, eventually buying into housing when the timing is better. But of course many people will say "I want to own my home. I want to renovate my home. I want to be able to do what I want to my home.", but not ignoring the market and riding the trend intelligently can lead to a better home purchase down the road, allowing ownership of a property that one can be even more proud of.

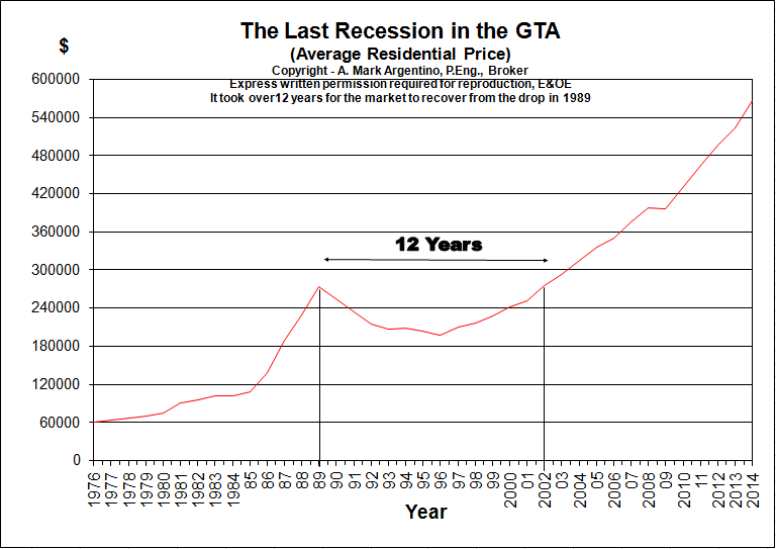

In my case, I plan to move out in my retirement, yes. But even then, that's a very long time from now. Weathering 12 years of a real estate dip if it happens won't be an issue.

As for renting vs a mortgage, for a detached home renting would be cheaper because I would rent a smaller home with a smaller lot. Yes, I would get something that filled my "needs" better, but if really just was considering needs, we'd live in a 3-bedroom apartment. OTOH, if I wanted to rent something equivalent to what I have now it'd be very difficult to find. And if I found it, it would be expensive. IOW, the reason why for some renting is cheaper is sometimes because they rent smaller homes with less amenities and/or if they bought they'd only put the bare minimum down, get CMHC insurance, and buy with a 25-year amortization. Yeah, in that case, buying gets expensive, but fortunately for some people in the GTA, they don't have to do that. There are an awful lot of people who either have the money already or else lucked out into buying starter homes in the 1990s (like me). Selling those homes went a long way to helping them out later on when they upsized. In my case I bought a pre-construction townhouse condo downtown back in the late 90s, and moved in a couple of years later. When I sold in 2007, the place had increased in price by 80%. And if I had kept it until today and then sold, it would have almost doubled again, meaning today it would cost over 3X what I paid for it back in the 90s.

BTW, as of about 3 years from now, my home will be paid off. Going forward after that I will be paying for general maintenance and utilities only. Actually, I will renovate the kitchen, but it's not as if it's a required expense. It's a desired expense as we spend a lot of time in the kitchen so we're willing to put some money into it. But excluding that, I'm estimating my costs for living in the home as of 2020 will be roughly 20% of what a rental would cost, and I plan on living there for another 20 years. Try finding a rental place for 20% of normal market rates.

Also, as mentioned before, in my area, foreign speculators are pretty much a non-issue on the residential side. There are basically no foreign bidders in detached home sales in the area. I won't deny it's an issue in some areas (eg. Willowdale), but location is an important factor. I suspect that is why there is so much disagreement amongst real estate agents about the impact of foreign speculators, because each region is different. Ironically, on the commercial side, some of the malls are foreign owned. They bought up uber cheap strip malls back like 30 years ago and put very little money into them. They keep them presentable enough to lease out and then just sat on them. They get lease income to cover their expenses and then some, but also waited for rezoning from commercial to mixed-use residential/retail before selling. And now they are selling to condo developers for huge profits. Those are the foreign speculators in my area, but they have nothing to do with the traditional residential market.

P.S. Had I known what I know now about the real estate market, I would have tried very hard to buy more than I needed back in the 90s. Back then I bought a 2 bedroom 1000+ square foot brick townhouse condo with attached shared 2-car garage. I paid $212000. There were 1400+ 3-bedroom townhouse condos for sale at the same time with 2 attached parking spots going for a little under $400000 IIRC. $400000 was within reach then but it would have been more difficult so I bought what I needed at the time, but quickly grew out of it. Now a family of 4, we wouldn't be happy at all in that 2-bedroom townhouse, but could have have made a go of it in a 3-bedroom townhouse. But we decided we wanted a detached home in a quiet area instead (although we moved out before we even had the kids).

I agree though that if I were just starting out now and was short on cash, I'd strongly lean toward renting. Indeed. I rented for several years in Toronto, although that was because I wasn't sure I'd be staying here long term. At the time I had calculated that with my finances, I'd have to stay a minimum of 5 years to just break even on buying. If I stayed less than 5 years, I'd lose money due to various expenses, and of course it'd be a big hassle to sell. However, if I knew my move to Toronto was permanent, I might have considered buying in the early 90s instead of the late 90s.

tl;dr:

Renting isn't necessarily cheaper than buying, even in Toronto. Renting can be cheaper if people renting gravitate to smaller homes with less amenities, and if they are comparing to the scenario where they have to put the minimum downpayment, get CMHC insurance, and amortize over 25 years. However, there are many buyers who aren't in that scenario, and buying for them would be much cheaper. Furthermore, the comparison between renting and buying is not the same for small condos vs. larger detached homes.