|

|

|

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Thread starter Oddball

- Start date

JonnyCanuck

Senior Member

Who here is confident that the Trans Mountain pipeline will start construction this year? We are already at the end of the first quarter. It is still stalled. Our federal government is talk but no action.

In the meantime, the U.S is pulling out all the stops for energy independence. Regulations have been rescinded. Thousands of KM's of new pipelines, LNG terminals etc to take their oil & gas to market, have been built in recent years.

Canada is going to regret this inaction when it is too late.

In the meantime, the U.S is pulling out all the stops for energy independence. Regulations have been rescinded. Thousands of KM's of new pipelines, LNG terminals etc to take their oil & gas to market, have been built in recent years.

Canada is going to regret this inaction when it is too late.

darwink

Senior Member

Construction has already started - lots to be done before pipe goes in the ground. The longest lead time thing is digging a tunnel under Burnaby mountain and they are doing site work for the right now. The federal government's job at this point is as the regulator - what do you propose they do? They can only respond to when there are actually problems and TMX applies and says it needs something, like it did when it permitted the project to go ahead without city permits, not just musings about future actions. The courts granted an injunction to stop protesters from getting too close for safety reasons.

I am 100% confident this will go forward. If the project does not due to provincial actions, stepping clearly on federal jurisdiction, basically there is no point in Canada being a country anymore. Canada will enter the worst unity crisis we have ever seen.

I am 100% confident this will go forward. If the project does not due to provincial actions, stepping clearly on federal jurisdiction, basically there is no point in Canada being a country anymore. Canada will enter the worst unity crisis we have ever seen.

JonnyCanuck

Senior Member

Another disturbing trend. RBC reports that investment capital is leaving Canada at an alarming rate, particularly in the energy sector. Gone with that will be skilled jobs & workers.

When is our federal & provincial governments going to wake up and realize that we could be headed for a zero growth economy in the near term? I have not heard whether the next premiers meeting has been scheduled but the threats to our economy including the likely demise of NAFTA must be at the top of the agenda.

When is our federal & provincial governments going to wake up and realize that we could be headed for a zero growth economy in the near term? I have not heard whether the next premiers meeting has been scheduled but the threats to our economy including the likely demise of NAFTA must be at the top of the agenda.

JonnyCanuck

Senior Member

https://globalnews.ca/news/4123026/oil-and-gas-canada-falling-behind-study/

Just what we need ... another expensive study to tell us what is obvious.

1. The price of oil is $35-40 less per barrel than it was in 2014.

2. We sell our heavy crude at a discount to the U.S because we don't have the capacity to refine it in Canada.

3. Where we do have refinery facilities on the west & east coast, we can't get pipelines expanded or built.

4. Our federal & provincial taxes are discouraging investment in Canada. Already several foreign companies have bailed and sold off their energy assets.

5. We continue to import oil to eastern Canada, from foreign countries, even though we have the total capacity to satisfy our own country's demand.

6. The U.S have de-regulated and reduced corporate taxes. They are changing from our #1 customer for oil & gas, to our #1 competitor.

OK federal government?... now send me a cheque for $280,000!

Just what we need ... another expensive study to tell us what is obvious.

1. The price of oil is $35-40 less per barrel than it was in 2014.

2. We sell our heavy crude at a discount to the U.S because we don't have the capacity to refine it in Canada.

3. Where we do have refinery facilities on the west & east coast, we can't get pipelines expanded or built.

4. Our federal & provincial taxes are discouraging investment in Canada. Already several foreign companies have bailed and sold off their energy assets.

5. We continue to import oil to eastern Canada, from foreign countries, even though we have the total capacity to satisfy our own country's demand.

6. The U.S have de-regulated and reduced corporate taxes. They are changing from our #1 customer for oil & gas, to our #1 competitor.

OK federal government?... now send me a cheque for $280,000!

darwink

Senior Member

4 isn't real either. Companies selling assets isn't a bad thing. Who would want to be in the dry natural gas market these days unless you had a nice fixed price offtake contract somewhere.In days past these assets would have been spun off as income trusts.

5 isn't a real thing that holds back the industry, but yeah the others are a problem. Long approval timelines for most things, high labour costs for everything, and extra requirements for some things (like LNG plants being built locally instead of in modules off shore) raise costs.

Here is a good presentation on pipeline capacity by Andrew Leach. https://drive.google.com/file/d/1j-L6HK_CIb6-Wj-C9Kya0J7LbkcbHB3g/view

5 isn't a real thing that holds back the industry, but yeah the others are a problem. Long approval timelines for most things, high labour costs for everything, and extra requirements for some things (like LNG plants being built locally instead of in modules off shore) raise costs.

Here is a good presentation on pipeline capacity by Andrew Leach. https://drive.google.com/file/d/1j-L6HK_CIb6-Wj-C9Kya0J7LbkcbHB3g/view

I'm not an expert in the economics of O&G by any means, but my simplistic view of the TransMountain pipeline is that it will allow us to sell to countries other than the U.S. which in turn should at least get us a decent price. Maybe not the WTI price, but close to it?

darwink

Senior Member

To the world price for comparable heavy, which is the Maya benchmark. It is also shorter so the toll will be lower (tolls are set based on the operating cost plus regulated returns on capital).I'm not an expert in the economics of O&G by any means, but my simplistic view of the TransMountain pipeline is that it will allow us to sell to countries other than the U.S. which in turn should at least get us a decent price. Maybe not the WTI price, but close to it?

We are also producing more oil than the current capacity to pipeline it (because a few existing pipelines are running below capacity). From the presentation linked to above:

Attachments

-

upload_2018-4-5_13-31-43.png58.5 KB · Views: 475

upload_2018-4-5_13-31-43.png58.5 KB · Views: 475 -

upload_2018-4-5_13-31-57.png82.2 KB · Views: 508

upload_2018-4-5_13-31-57.png82.2 KB · Views: 508 -

upload_2018-4-5_13-32-15.png81.2 KB · Views: 500

upload_2018-4-5_13-32-15.png81.2 KB · Views: 500 -

upload_2018-4-5_13-32-44.png175.3 KB · Views: 512

upload_2018-4-5_13-32-44.png175.3 KB · Views: 512 -

upload_2018-4-5_13-33-12.png127.9 KB · Views: 528

upload_2018-4-5_13-33-12.png127.9 KB · Views: 528 -

upload_2018-4-5_13-33-28.png127.8 KB · Views: 492

upload_2018-4-5_13-33-28.png127.8 KB · Views: 492 -

upload_2018-4-5_13-35-9.png104.1 KB · Views: 507

upload_2018-4-5_13-35-9.png104.1 KB · Views: 507 -

upload_2018-4-5_13-35-26.png128.6 KB · Views: 527

upload_2018-4-5_13-35-26.png128.6 KB · Views: 527

Social Justice

Active Member

To the world price for comparable heavy, which is the Maya benchmark. It is also shorter so the toll will be lower (tolls are set based on the operating cost plus regulated returns on capital).

We are also producing more oil than the current capacity to pipeline it (because a few existing pipelines are running below capacity). From the presentation linked to above:

View attachment 139329

View attachment 139330

View attachment 139323

View attachment 139324

View attachment 139325

View attachment 139326

View attachment 139327

View attachment 139328

Interesting! Can you link the source or website for the info?

darwink

Senior Member

https://drive.google.com/file/d/1j-L6HK_CIb6-Wj-C9Kya0J7LbkcbHB3g/viewInteresting! Can you link the source or website for the info?

Habanero

Active Member

If Transmountain goes ahead which it seems to be doing it'll triple the current 300k barrels a day to almost 900k, but we would still have a shortage from the looks of it.

darwink

Senior Member

Only post 2040.If Transmountain goes ahead which it seems to be doing it'll triple the current 300k barrels a day to almost 900k, but we would still have a shortage from the looks of it.

To the world price for comparable heavy, which is the Maya benchmark. It is also shorter so the toll will be lower (tolls are set based on the operating cost plus regulated returns on capital).

We are also producing more oil than the current capacity to pipeline it (because a few existing pipelines are running below capacity). From the presentation linked to above:

Thx! so even if we got close to the price of Maya.....say $52.00/bbl that would still be $10.00/bbl extra. I don't know how many barrels per day we export out of the country, but the current Keystone must be all export? Getting that $10/bbl would add quite a bit of revenue into Canada, on top of the added number of barrels.

darwink

Senior Member

Well, that is the great thing about prices, if we can get that $10 for the marginal barrel, that becomes the price for ALL barrels. So it is a huge difference.

Oddball

Senior Member

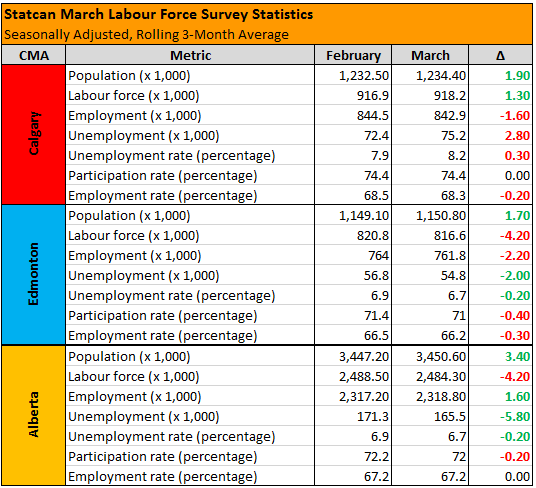

The March LFS is out. The headlines this morning were all about full-time employment growth so I was hoping we might be in on that. Sadly it wasn't to be. Things were pretty flat for us.

The city still grew based on the estimates, but we lost employment and gained unemployment. Both by fairly small margins. The result was a fairly substantial bump in the overall unemployment percentage back above 8%. It hasn't been that high since October. There are a few faint silver linings I guess. The participation rate remained where it was and based on the unadjusted numbers, most of the employment losses might have been part-time rather than full time. Though there were losses for both.

Pretty blah month all told. I wonder if the weather played a part? Golf courses and agriculture related businesses are probably getting started late.

Edmonton's story is pretty similar to last month unfortunately for them. The unemployment rate dropped, but so did the labour force as a whole. The continued to lose jobs while improving their unemployment rate. This is actually their 3rd consecutive month of employment decreases since peaking back in Decemeber.

Alberta as a whole looks a little brighter. The labour force shrank, but equal to the amount that Edmonton did interestingly. Employment was up, unemployment was down and the unmployment rate declined, but so did the participation rate. More good than bad in there I'd say. The number I always want to see the most is Employment trending in the right direction and it is, at least provincially.

The city still grew based on the estimates, but we lost employment and gained unemployment. Both by fairly small margins. The result was a fairly substantial bump in the overall unemployment percentage back above 8%. It hasn't been that high since October. There are a few faint silver linings I guess. The participation rate remained where it was and based on the unadjusted numbers, most of the employment losses might have been part-time rather than full time. Though there were losses for both.

Pretty blah month all told. I wonder if the weather played a part? Golf courses and agriculture related businesses are probably getting started late.

Edmonton's story is pretty similar to last month unfortunately for them. The unemployment rate dropped, but so did the labour force as a whole. The continued to lose jobs while improving their unemployment rate. This is actually their 3rd consecutive month of employment decreases since peaking back in Decemeber.

Alberta as a whole looks a little brighter. The labour force shrank, but equal to the amount that Edmonton did interestingly. Employment was up, unemployment was down and the unmployment rate declined, but so did the participation rate. More good than bad in there I'd say. The number I always want to see the most is Employment trending in the right direction and it is, at least provincially.