TAS

Senior Member

A recap of the past 18 months with local investors buying up $135 million worth of office buildings (11 of the 12 were owned by non locals).

edmontonjournal.com

edmontonjournal.com

- Whitemud Business Park

- Broadmoor Boulevard (Broadmoor Place A and B and VII and VIII)

- Clark Builders Place

- 5241 Calgary Tr.

- 10451 170 St.

- Compass Place

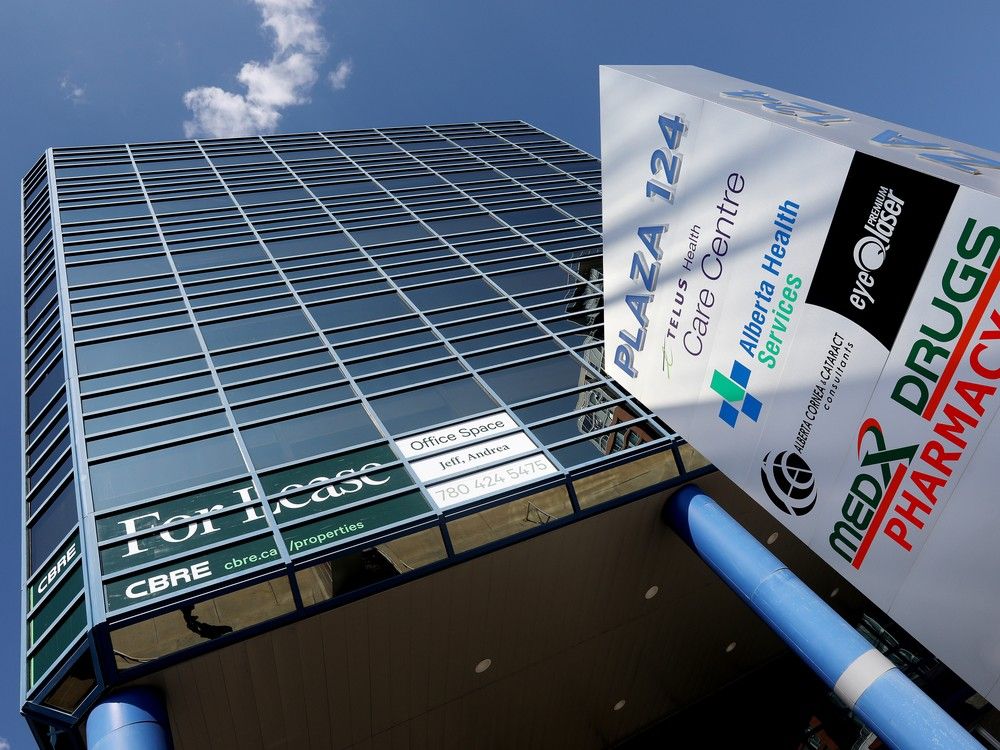

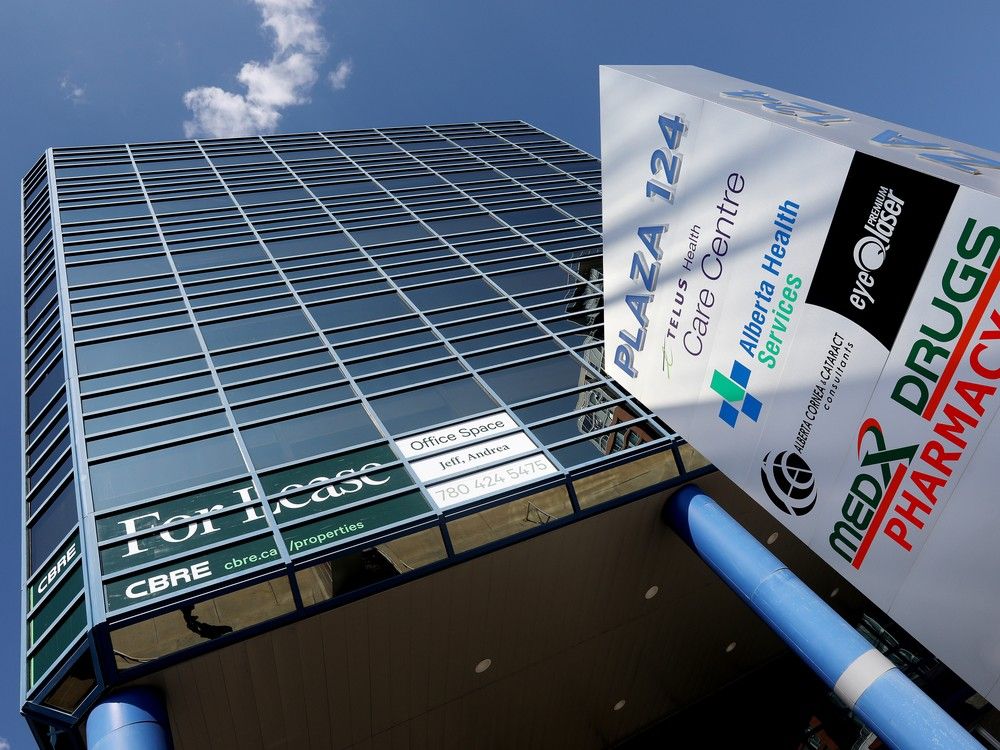

- Plaza 124

- Parkwest Business Centre

- Phipps McKinnon Building

- Empire Building

- Sun Life Place

Edmonton investors snatch up 12 local buildings

"I think it's a real testament to those that are in the trenches here. They see an opportunity"