Northern Light

Superstar

The CafeTO item cleared Executive Ctte today, but with an amendment from the Mayor:

At just over half a percentage point of the annual budget (I'm assuming approximately 10 billion) that's essentially a rounding error. Much ado about nothing.Mayor Tory is just wrapping up a press conference for the City Budget, which he had to formally present for the Council meeting mid-month that is to approve same.

The only material change is that staff have 'found' savings of an additional 6M, and he's open on how to allocate those dollars to assorted priorities including housing, climate change and transit.

****

A wholly inadequate concession on the Mayor's part.

6M will not materially alter anything. If applied entirely to the TTC service cuts, it would reduce them somewhat, and leave no additional $$ for anything else.

At just over half a percentage point of the annual budget (I'm assuming approximately 10 billion) that's essentially a rounding error. Much ado about nothing.

The first 3 / 6 property tax is based on 50% of the 2022 taxes.I just received my first three of six 2023 property tax bills. And it’s down $15 from my final three tax bills from 2022. I was expecting an increase since my assessed value is up and Mayor Tory is crying poor. I assume the final three of 2023 will be up.

And I just received my January gas bill, and it’s up only $12 from Jan 2022. I thought inflation was hitting gas prices hard? I‘ve read of people getting gas bills with huge increases. Maybe that’s coming in my Feb or March bills.

.jpg)

From link...

Top tips to heat your home for less

Adjust your thermostat

.jpg) Lowering the temperature of your home two to three degrees Celsius is optimal for saving energy and keeping your home comfortable. A good guide is to program 17°C when you are sleeping or not at home, and 20°C when you are awake and at home. Keep it simple and install an ENERGY STAR certified smart thermostat so you can set it and forget it.

Lowering the temperature of your home two to three degrees Celsius is optimal for saving energy and keeping your home comfortable. A good guide is to program 17°C when you are sleeping or not at home, and 20°C when you are awake and at home. Keep it simple and install an ENERGY STAR certified smart thermostat so you can set it and forget it.

Except in Toronto it seems...

From link...

All landlords are responsible for providing heat to a minimum air temperature of 21 degrees Celsius from September 15 to June 1.

Guess we have city council members who have shares in heating supply companies.

Good.Except in Toronto it seems...

Walter............

Bad take.

Older and ill people in particular are quite vulnerable to the cold.

I'm a guy, a well insulated one at that! LOL I like it cool; and dislike the warmth; but when its been 19 degrees in my unit in winter, in the past, before the windows were re-done, it was not comfortable.

The 21 degree standard is high, but it also reflects a lack of thermostats in people's individual apartments.

The standard was advised on by professionals as is a common choice.

Some days you really do go out of your way to complain about everything.

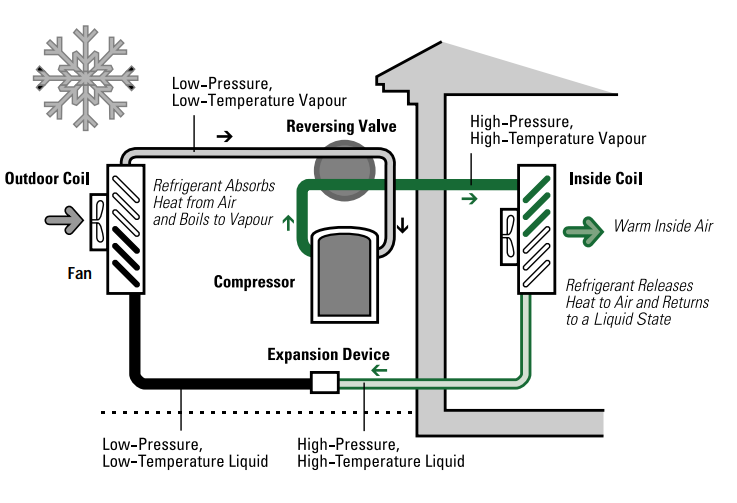

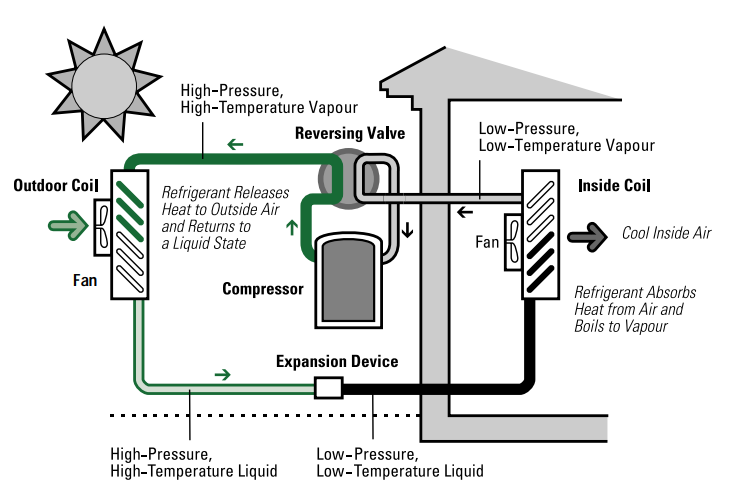

Supplementary Heat Sources

Since air-source heat pumps have a minimum outdoor operating temperature (between -15°C to -25°C) and reduced heating capacity at very cold temperatures, it is important to consider a supplemental heating source for air-source heat pump operations.

As they and most municipalities have done for many years the interim tax bill is 50% of the total tax assessed in the previous year. "As property tax is a large obligation relative to other (non-financing) home ownership costs, cities typically want to ensure residents have enough time. However, budgets for the year (and subsequently, tax rates) are not typically financed until the end of the first quarter of the year. Because of this, the city usually issues two bills: an interim bill and a final bill.I just received my first three of six 2023 property tax bills. And it’s down $15 from my final three tax bills from 2022. I was expecting an increase since my assessed value is up and Mayor Tory is crying poor. I assume the final three of 2023 will be up.

And I just received my January gas bill, and it’s up only $12 from Jan 2022. I thought inflation was hitting gas prices hard? I‘ve read of people getting gas bills with huge increases. Maybe that’s coming in my Feb or March bills.

Vacant Home Tax Calculation

A Vacant Home Tax of one per cent of the Current Value Assessment (CVA) will be imposed on all Toronto residences that are declared, deemed or determined vacant for more than six months during the previous year. For example, if the CVA of your property is $1,000,000, the tax amount billed would be $10,000 (1% x $1,000,000).

The tax is based on the property’s occupancy status for the previous year. For example, if the home is vacant in 2022 the tax will become payable in 2023.

If your property status declaration is not made by the declaration deadline of February 2, 2023, a fine of $250 may be issued.

You will have an opportunity to submit a late declaration and based on your response, you may receive a supplementary Vacant Home Tax Notice.

Failure to make a declaration will result in your property being deemed vacant. Once deemed vacant, your property will be subject to the tax and you will be issued a Vacancy Tax Notice.