According to this analysis, we can expect the 45 Bay St. parking lot to stick around for a while. Interesting points: [1] Cadillac Fairview will investing $100 million inupgrades to the TD Centre. [2] The next BAC tower will be completed "within the decade."

http://network.nationalpost.com/np/...cancies-to-exceed-new-york-boston-report.aspx

Toronto's office-tower vacancies to exceed New York, Boston: report

Posted: November 24, 2009

By Doug Alexander

A surge in office construction in Toronto’s downtown may push the city’s vacancy rate higher than New York and Boston after developers added space during the first recession in 17 years.

The proportion of empty space in Toronto’s office market, lower than the 12 largest U.S. business districts last year, will more than triple by 2011 to 13.6%, according to Cushman & Wakefield Inc. Brookfield, Cadillac Fairview Corp. and Menkes Developments Ltd. each added a glass skyscraper in the past five months.

“We’re going to have a little bumpy ride for the next couple of years,” said Paul Morse, Cushman & Wakefield’s senior managing director of office leasing in Toronto. “We’re not going to see too many buildings after this because the economics aren’t really there to support it.”

The three new towers increased the amount of office space in Toronto by about 3.2 million square feet (300,000 square metres). That’s nearly as much as was added during the previous 17 years combined, according to Cushman & Wakefield, and more is coming. Construction is under way on a 26-storey complex on York Street that will be used by accounting firm PricewaterhouseCoopers LLP when it opens in 2011.

The skyscrapers that opened this year will enable Royal Bank of Canada, RBC Dexia Investor Services, KPMG LLP and Telus Corp. to move into larger premises with room for expansion. For the owners of the vacated properties, the tenants may be difficult to replace.

“You’re moving from basically eight buildings into these three,” said John O’Bryan, vice chairman of broker CB Richard Ellis Ltd. in Toronto. “The issue is, over the next 12, 24 months, who backfills those buildings?”

Office vacancies in Toronto’s central area, which includes the financial centre, downtown and midtown areas, will rise to 7.8% by the end of this year, according to Cushman & Wakefield, the world’s biggest closely held commercial-property broker. Vacancies, which were 4.4% at the end of 2008, will jump to 12.1% next year and peak in 2011. By contrast, Midtown Manhattan’s rate will rise to 13.4% by 2011, from 8.5% last year. Boston’s rate will rise to 13.1% from 8.3% in 2008.

Toronto’s latest office building, the 30-floor Telus centre, officially opens Wednesday and is the third tower to be completed since June. The buildings increased the total amount in downtown Toronto by 5%.

Telus, a Vancouver-based telecommunications company, is moving 1,800 workers from 15 suburban locations to its $250-million building on York Street starting this month. More than 80% of the 780,000 square-foot building is leased with Telus as the main tenant.

The Toronto-Dominion Centre, the six-tower complex in the heart of the financial district, has lost tenants to the new buildings. Royal Bank and RBC Dexia Investor Services vacated 380,000 square feet in the 40-year-old Royal Trust Tower to relocate to RBC Centre on Wellington Street West, which opened in June (and is pictured above). Both complexes are owned by Cadillac Fairview, the real-estate unit of the Ontario Teachers’ Pension Plan.

Cadillac Fairview plans to upgrade TD Centre in a project worth “close to $100-million,” said John Sullivan, executive vice-president of development. He expects a short-term “blip” in vacancies as the towers open, though not all downtown properties will be equally affected.

“You’re going to see some of the vacancy concentrated in many of the older and less maintained properties,” Mr. Sullivan said. “We’re just fortunate that all of our inventory in downtown Toronto is not of that ilk.”

Toronto’s estimated office vacancies will be less than the 18.8% peak in 1993, according to Cushman & Wakefield. Vacancies last exceeded 12% from the fourth quarter of 1991 to the first quarter of 1997.

Toronto weathered the recession better than other North American cities due partly to the strength of its main tenants: banks and other financial-services firms. In September, Canadian lenders were ranked the world’s soundest for the second straight year by the Geneva-based World Economic Forum.

“The good news for the downtown has really been the performance of the financial institutions,” Mr. O’Bryan said. “They, by and large, have not shed space and some of them are adding people.”

Royal Bank, Canada’s largest lender, and RBC Dexia are the main tenants of the 43-floor RBC Centre. About 5,000 employees are relocating from four buildings to the 1.2-million-square- foot center, which is 75% leased. RBC Dexia, a partnership between Royal Bank and Dexia SA, employs about 2,000 of those workers, who’ve already moved in to eight floors.

“There’s a lot of space for growth, so when new business comes on board and we’re expanding, we don’t have to worry about finding space in four buildings,” RBC Dexia chief executive Jose Placido said.

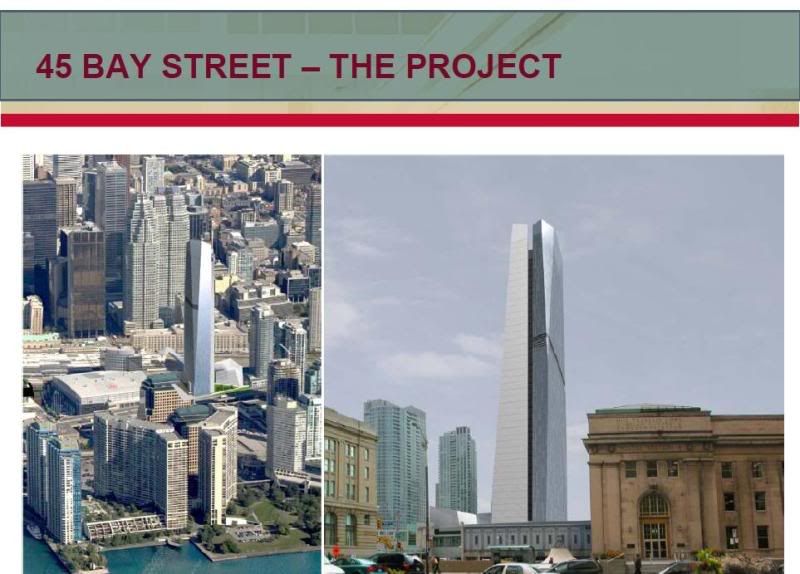

KPMG is the main tenant for Bay Adelaide Centre, a 51-floor tower opened in September by Brookfield Properties. The firm is vacating 236,644 square feet at the nearby Commerce Court West tower owned by a unit of Great-West Lifeco Inc. to take more space for 1,200 employees. The building is across the street from Donald Trump’s 60-story hotel and condominium tower on Bay Street, slated for completion in 2011.

The 1.2-million-square-foot Bay Adelaide Centre is 73% leased and other firms are negotiating leases for the rest, said Tom Farley, CEO of Brookfield Property’s Canadian commercial operations.

“We’re seeing leasing activity increase in the last couple of months,” Mr. Farley said. “There’s a greater level of confidence by businesses and an expectation that we are out of a recession and they can start implementing their business plans.”

Brookfield, which owns 13 Toronto buildings, is planning a second phase for Bay Adelaide Centre, a 900,000-square-foot tower that Farley says will be done “within a decade.” A proposed third tower may become condominiums instead of offices, depending on demand, Mr. Farley said.

Toronto’s soaring vacancies may be a boon for tenants as the economy recovers.

“The next two or three years for the landlords are going to be a grind downtown,” Mr. O’Bryan said. “Tenants will be the winners.”