The way I see it we have two options:

Option A: Lower corporate taxes to between 0 and .25% to increase investment in Canada.

Corporate Taxes in Canada are at historic lows. The consolidated corporate tax rate in Ontario is currently 26.5%. This compares to 42% in the early 90s.

So we've already cut corporate tax, on its face, by 37%

But on top of that, we've reduced commercial property tax rates, we've slashed capital gains taxes, (applies to business and individuals) and permitted accelerated capital cost depreciation in which a business can aggressively write down new investments in plant and equipment faster that would have been historical permitted.

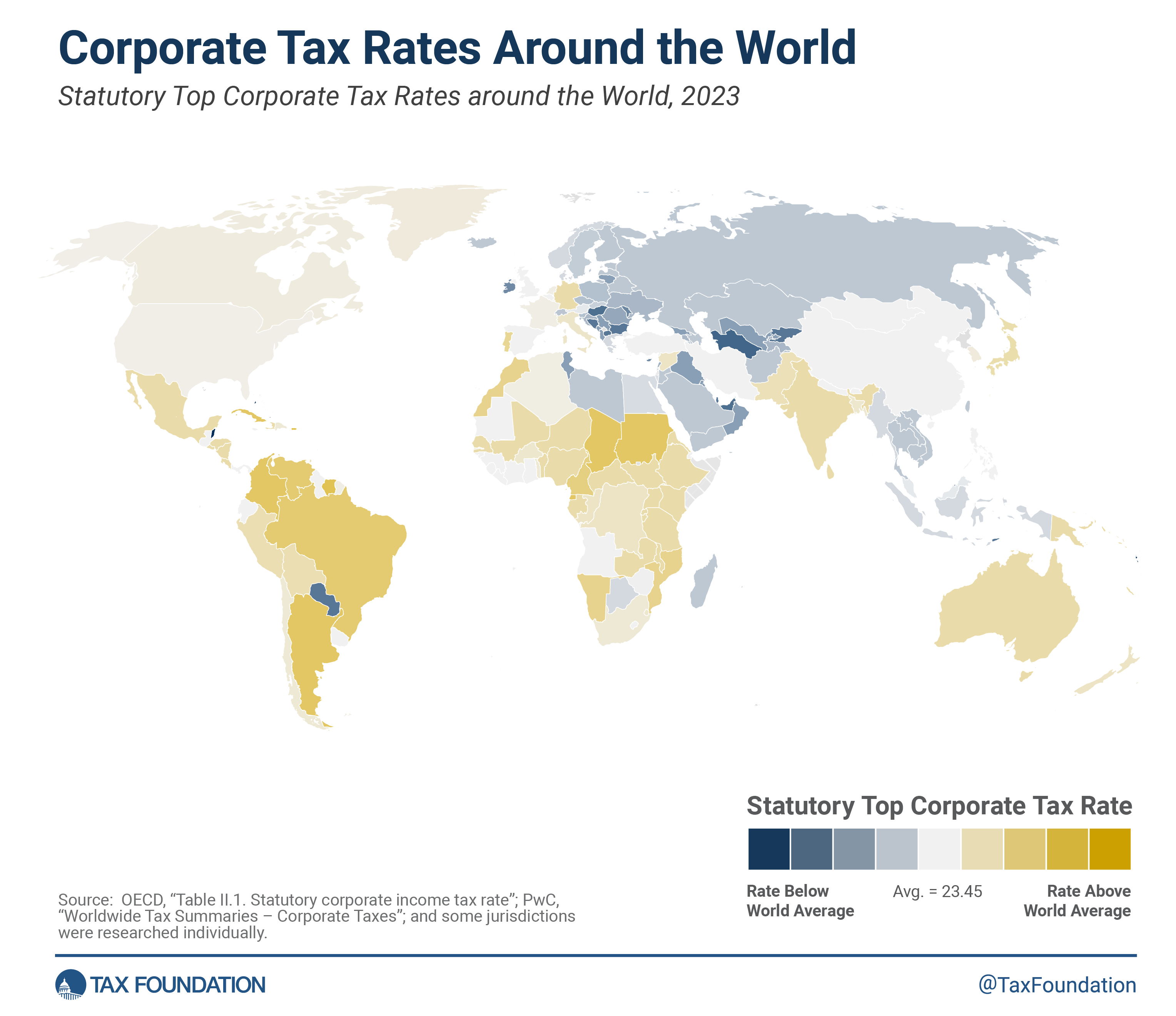

We're almost dead-on in corporate tax rates vs the G7 and OECD averages with both at 26% and change.

Corporate tax rates have declined over the past four decades due to countries turning to more efficient tax types. However, they have leveled off in recent years.

taxfoundation.org

There is little evidence that lowering our corporate tax rates would foster additional productivity or investment. Indeed, these have declined as we've lowered said rates.

Eliminate other barriers to investment by doing such things as allowing foreign competition into the market for things like grocery and telecommunications. Make it easier for companies like Tesco, Lidl, Verizon, T-Mobile and EE to come here.

The barriers to a foreign grocer entering the market are not regulatory.

There is no rule against foreign grocers in Canada.

The problem is 3 absolutely behemoth grocers that have a lock on the retail and wholesale sides of the business and have real estate here locked up pretty good too through affiliated REITS.

If you want to change that, the required action is to break up the existing grocers. To order Empire to split Freshco off into its own company, and then split Farm Boy, Longos and Sobeys.

To order Loblaws to part ways with Shoppers Drug Mart and No Frills.

To Order Metro to spin off Food Basics.

And to prohibit any real estate agreements that preclude or inhibit competition.

****

On Telcos, while we could and maybe should relax foreign ownership limits.......it also means potentially trading away some of the few large Canadian owned, controlled and headquartered companies.

Most foreign telcos would not come into the Canadian market and build infrastructure from scratch over a huge country like ours, they would buy an existing player.

Its not clear how much that would benefit competition.

I think we need to use regulatory muscle to have low wholesale rates and open-access to existing fiber and cell networks to drive competition.

We also need to limit telcos from being in unrelated businesses which they then cross-subsidize (Bell Media) (Rogers Media) etc. Further we need to cap their debt levels as well.

Disband the various farm and food boards like those for wheat and dairy. Also eliminate any controls and restrictions they placed such as quotas.

Don't get me wrong, I think supply management as currently operating is failing Canadians, but just so we're clear, doing away with it would either kill those industries almost entirely, or we would do as most other developed countries do, including the U.S. and subsidize the hell out of those industries to keep them afloat.

The U.S. has a Strategic American Cheese Reserve, it uses the school lunch program to subsidize dairy, and has other direct agricultural subsidies. So do most other countries.

We avoid that by allowing artificial limits on supply and inflated consumer prices. Change that out, and be prepared to see a solid 10B annually in new tax dollar transfers to those sectors.

Option B:

Keep taxes the same and kill all discretionary spending along with foreign aid.

What is 'all discretionary spending'. You need to spell that out.

Is that the National Child Benefit? Is that the new Dental program? What exactly is discretionary?

Foreign Aid is a tiny percentage of Federal spending in Canada

Depending on what you include it runs between ~11.5B and just over 16B per year.

That number includes also sorts of things, its not just a big blog of unconditional transfers. Much of the money ends up working its way back to Canadian business, as it may subsidize the purchase of food or supplies made in Canada.

Make painful cuts and pay down the debt.

I agree with greater efficiency and with paying down the debt; but as a global strategy for competitiveness, I think its a bit under baked.