We may not be experiencing stagflation this time around but anyone who wholeheartedly believes that the shift towards downtown living is anything but a trend driven by investors is living a pipe dream.

Re-sale prices are dropping and corporate housing is being hit HARD. I don't know but I'd say it's a good time to pull out and cut you're losses before another 40,000 condos and hotel suites are completed.

- Corrected grammar and spelling mistakes, sorry.

While I don't disagree that all the condos in the pipeline create the real risk of further deterioration in condo prices over the next 3 years (although i believe that will be limited only condo's under $350 000, under 700 sq ft, and a further 10-20% drop), the shift to downtown living IS anything but a trend driven by investors.

In Liberty Village, for example, the number of investor bought units - in any of the developments - is phenomenally low. Zip just closed this month and as far as all my sources have been able to tell me, investor units totalled less than 5-10%.

While Maple Leaf, etc. might have a higher proportion of investors, most of these units will find renters - who are also people who desire to live downtown. If they don't, the prices will drop and people will buy them - again, to live downtown.

This most recent condo surge is completely unlike the condo surge in the 1990's and it seems like some people on this board who were around then are unable to distinguish the difference. In the 1990's, it was affordability that drove people to condo's. House prices were simply too much for the average downtown Torontonian, so they

grudgingly bought a condo, but were a bit embarassed by it.

This is not the case anymore. As this condo surge built up, anything bought pre-2007 was mostly bought by end users and a condo has not only become a good way to get into the market because of high house prices (same reason as the 1990's), but a desirable, aesthetically pleasing, and for a large percentage of owner's a better alternative to owning a home.

In other words, a massive sea-change in attitudes towards condo living has happened - partly as a result of evolving environmental attitudes, desire for free time/access to amenities that only an urban centre can provide/freedom from the constraints of an automobile, and increased immigration. Most major urban populations on this planet - from London to Paris, New York to Sydney, Moscow to Johannesburg live and own CONDO's, not houses. It's a preferred means of living, not to mention the only sustainable way of living. Toronto has simply caught up.

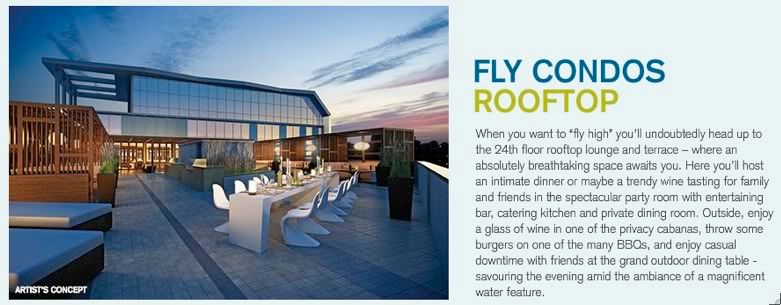

To stay on the issue of FLY however, I was in their sales office the other day and liked the interiors I saw - they had a high quality of standard finish. The $159900 suites are 400 sq ft and priced about $50 ft less than any other suite they are offering. The exterior however is just another boring box with offset balconies and is nothing to write home about.