IanO

Superstar

Highlights

Highlights

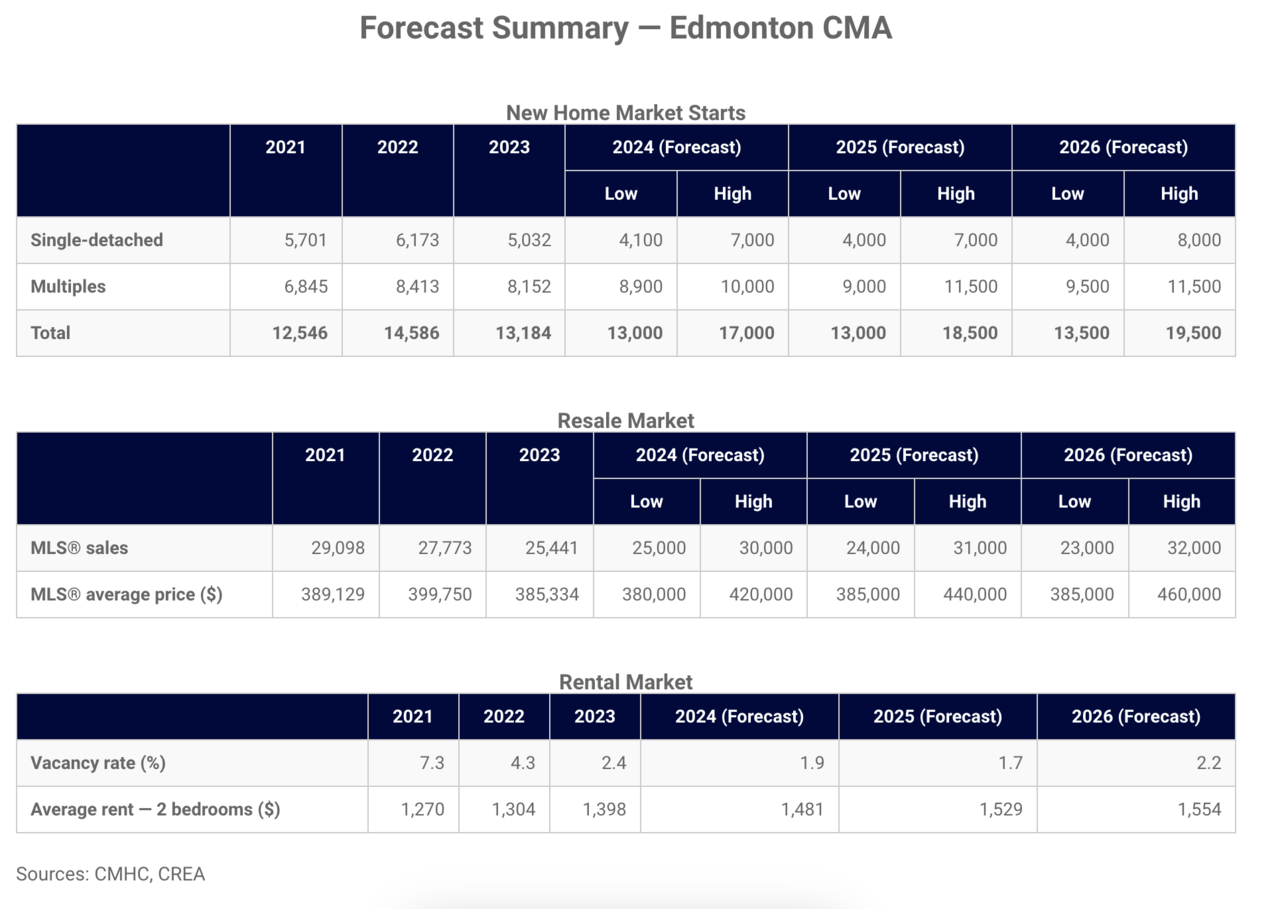

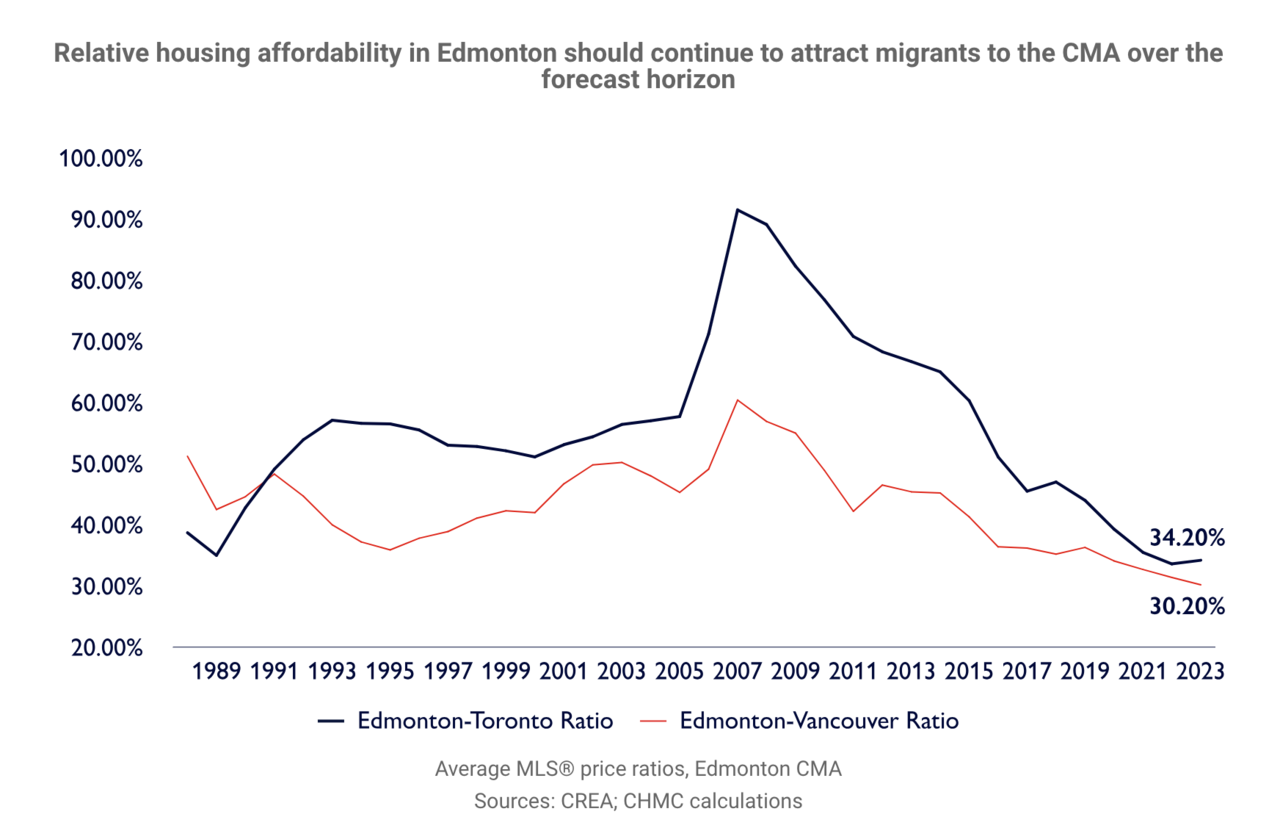

- Strong housing starts: Total housing starts are forecasted to remain robust, propelled by economic fundamentals and a strong demand for lower-priced multi-unit housing developments.

- Resale market growth: Resale market transactions are expected to grow modestly, accompanied by an increase in the average price. Potential homeowners may face challenges due to reduced borrowing capacity and limited inventory of lower-priced units.

- Edmonton rental market outlook: The rental market in Edmonton is projected to stay tight, with rental demand surpassing supply, leading to lower vacancy rates and higher average rents throughout most of the forecast period.

2024 Housing Market Outlook

Explore our housing forecasts for affordability, supply and other key housing issues and find the latest trends in Canada's housing market.

www.cmhc-schl.gc.ca