evandyk

Senior Member

I'm all for an increase to sales tax, but it should be the provinces doing it. And going from 5% to 30% could be a little disruptive...

|

|

|

Is that how it works? If I paid $300k for my house in 1998 and when I die it's worth $2 million, aren't my heirs expected to pay capital gains on the $1.7 million growth in the property?Those people already have to pay capital gains taxes on the property they're passing on. The only difference is a slightly smaller share of their investment income will be tax free than it previously had been.

And no, it doesn't impact anyone who owns property and wants to pass it on. It only impacts those people whose property has increased by more than $250,000. And for most people who have a single piece of property worth that much, that property is their principal residence, which is not affected.

I'm all for an increase to sales tax, but it should be the provinces doing it. And going from 5% to 30% could be a little disruptive...

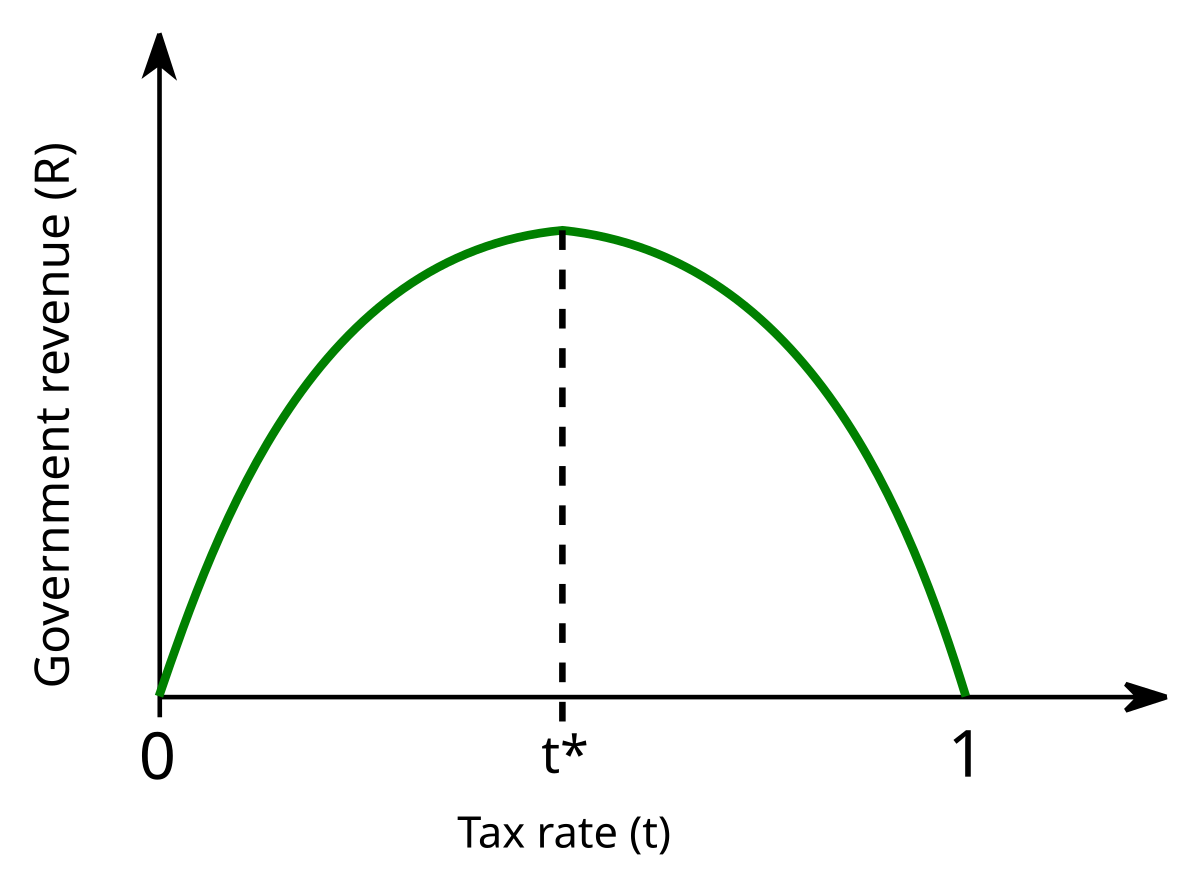

I would support a 1-2% increase in the GST as long as it went to cities, as this essentially returns the GST rate to its original 15%.Yes but it would increase revenue.

Nope. As others have mentioned, a principle residence is exempt. Other real property such as a cottage are not.Is that how it works? If I paid $300k for my house in 1998 and when I die it's worth $2 million, aren't my heirs expected to pay capital gains on the $1.7 million growth in the property?

Bit of a class warfare statement don't you think? I know several people who have summer cottages I can testify that none of them are Scrooge McDucks giggling on their pile of gold coins. Many, including my wife's parents, built one on a crown land purchase back in the 1960s in Haliburton. If I recall, the original land and cottage kit price (Beaver Lumber I think) was under $10K. Single income - five kids. A friend has one on Lake Muskoka that goes back to probably the 1940s that looks to be equally basic. If I recall, his dad drove a fuel truck.Primary homes are exempt from capital gains.

I don't think most people are going to shed too many tears on the poor downtrodden folks who are selling their additional properties they're hording having to pay an extra taxes on profits over $250,000.

The worst thing to do with cottages is to bequeath the property to more than one heir. If multiple extended families own the property you often end up in squabbles over availability, shared funding of maintenance and cleaning/upkeep, especially if a less wealthy sibling cannot as easily pay their share. And statistically one of your offspring is bound to end up divorced, which leads to legal disputes over property with ex-spouses. Even for primary properties you need to be careful, we intend to bequeath this house to the one kid who wants to stay urban, while the other kid who's more rural minded will get more money.Sure, there are McMansions in cottage country, but many are generational ownership. They're not 'hoarded', most are passed down, or at least intended to be.

One trick is to "transfer" the cottage to your adult offspring before you die. https://www.advisor.ca/tax/estate-planning/best-tax-options-to-transfer-the-cottage-to-kids/One problem is general inflation, particularly in the value of vacation properties, means that it can often consume the rest of the value of the estate to pay the taxes unless other steps are taken prior.

Nope. As others have mentioned, a principle residence is exempt. Other real property such as a cottage are not.

Bit of a class warfare statement don't you think? I know several people who have summer cottages I can testify that none of them are Scrooge McDucks giggling on their pile of gold coins. Many, including my wife's parents, built one on a crown land purchase back in the 1960s in Haliburton. If I recall, the original land and cottage kit price (Beaver Lumber I think) was under $10K. Single income - five kids. A friend has one on Lake Muskoka that goes back to probably the 1940s that looks to be equally basic. If I recall, his dad drove a fuel truck.

We used to live near Tiny Beaches on Georgian Bay. There are still a lots of original, small basic cottages there.

Sure, there are McMansions in cottage country, but many are generational ownership. They're not 'hoarded', most are passed down, or at least intended to be. One problem is general inflation, particularly in the value of vacation properties, means that it can often consume the rest of the value of the estate to pay the taxes unless other steps are taken prior.

Other types of capital gains are reported annually via T3s, T5s, etc. One problem with applying it to real property is there is currently no reasonable mechanism to annually value the property in order to calculate the gain. Property valuation is a provincial responsibility, and I foresee no possibility in any kind of information-sharing between all the jurisdictions. Imagine holding a stock or other type of financial asset for 40 or 50 years then having to pay all the gain.

If they are holding million dollar properties, they have won the real estate lottery. Why should anyone shed tears for them keeping a bit less of the massive windfall vs renters paying 40% of income for a shoebox.Nope. As others have mentioned, a principle residence is exempt. Other real property such as a cottage are not.

Bit of a class warfare statement don't you think? I know several people who have summer cottages I can testify that none of them are Scrooge McDucks giggling on their pile of gold coins. Many, including my wife's parents, built one on a crown land purchase back in the 1960s in Haliburton. If I recall, the original land and cottage kit price (Beaver Lumber I think) was under $10K. Single income - five kids. A friend has one on Lake Muskoka that goes back to probably the 1940s that looks to be equally basic. If I recall, his dad drove a fuel truck.

We used to live near Tiny Beaches on Georgian Bay. There are still a lots of original, small basic cottages there.

Sure, there are McMansions in cottage country, but many are generational ownership. They're not 'hoarded', most are passed down, or at least intended to be. One problem is general inflation, particularly in the value of vacation properties, means that it can often consume the rest of the value of the estate to pay the taxes unless other steps are taken prior.

Other types of capital gains are reported annually via T3s, T5s, etc. One problem with applying it to real property is there is currently no reasonable mechanism to annually value the property in order to calculate the gain. Property valuation is a provincial responsibility, and I foresee no possibility in any kind of information-sharing between all the jurisdictions. Imagine holding a stock or other type of financial asset for 40 or 50 years then having to pay all the gain.

Exactly. That's why we walked away before her parents passed. It wasn't really a big deal for me - I never grew up with a cottage and viewed them as just another place to look after.The worst thing to do with cottages is to bequeath the property to more than one heir. If multiple extended families own the property you often end up in squabbles over availability, shared funding of maintenance and cleaning/upkeep, especially if a less wealthy sibling cannot as easily pay their share. And statistically one of your offspring is bound to end up divorced, which leads to legal disputes over property with ex-spouses. Even for primary properties you need to be careful, we intend to bequeath this house to the one kid who wants to stay urban, while the other kid who's more rural minded will get more money.

One trick is to "transfer" the cottage to your adult offspring before you die. https://www.advisor.ca/tax/estate-planning/best-tax-options-to-transfer-the-cottage-to-kids/

Yes they have and I don't expect anyone to shed a tear, but sometimes it strikes me as a form of 'asset envy'. There are some who call for all non-earned income to be taxed at 'interest-level' (i.e. the highest rate). Capital gains are embedded in public and private pension plans, RSP, mutual funds, etc.If they are holding million dollar properties, they have won the real estate lottery. Why should anyone shed tears for them keeping a bit less of the massive windfall vs renters paying 40% of income for a shoebox.

One thing I could get behind is letting taxpayers voluntarily recognize a portion of the capital gains, pay the associated tax and increase the adjusted cost basis in a given tax year to spread the gain over multiple years. The goal of the policy was not to squeeze people who on average have modest capital gains income but have infrequent balloon gains.Exactly. That's why we walked away before her parents passed. It wasn't really a big deal for me - I never grew up with a cottage and viewed them as just another place to look after.

A pre-estate transfer is one way but can still have tax implications since the gains are 'crystalized' at the time of transfer. There are others, such as informal trusts, a life insurance policy to the projected value of the property, etc. Lawyers and advisors make a living off this stuff.

Yes they have and I don't expect anyone to shed a tear, but sometimes it strikes me as a form of 'asset envy'. There are some who call for all non-earned income to be taxed at 'interest-level' (i.e. the highest rate). Capital gains are embedded in public and private pension plans, RSP, mutual funds, etc.

I'm not saying that the government shouldn't tax capital gains, even residences, just that they can't lump multiple years of asset gain into a single tax year.

No doubt a future generation will look upon some aspect of the current generations and view it as a cash cow. 'They got subsidized daycare? Retro tax it as a benefit'.

Yes they have and I don't expect anyone to shed a tear, but sometimes it strikes me as a form of 'asset envy'. There are some who call for all non-earned income to be taxed at 'interest-level' (i.e. the highest rate). Capital gains are embedded in public and private pension plans, RSP, mutual funds, etc.

I'm not saying that the government shouldn't tax capital gains, even residences, just that they can't lump multiple years of asset gain into a single tax year.

I really can't get into an economics policy debate since I am virtually unarmed, but I'm not sure, if you drill down, that many people who propose that all income, whether it be earned, interest, dividends or capital gains, treated the same, really don't. They simply want income that they don't have but others do, or deductions that others get but they don't, changed. axed more heavily. when the topics of RSPs, tuition and other adjustments are raised.Interest income is taxed exactly the same as employment income, as 'regular income'.

The rates on qualifying income only change progressively (the more you make, the more you pay)

Its the inclusion rates that are different with capital gains.

The giveaways are myriad. I say that as someone who benefits even as a non-real estate owner.

When I buy stock, say $10,000 worth, just to keep the math easy. That stock, all going well increases in value by 25% over six months (50% annualized), I sell it for $12,500, minus some transaction fees.

So I realize a gain of $2,300 Not dissimilar to many people's pay cheque.

But the typical employed person will pay tax on the entirety of that $2,300 (minus the same basic exemption we all get, ~$15,000 for the year)

For argument's sake, their income is entirely in the lowest bracket, so they will see 20% deducted (they will get some back when they file a tax return), they also get CPP and EI deducted.

But me, I get nothing deducted at source, when I do file, assuming I had no offsetting capital losses, I get to pretend my $2,300 in income is only $1,150.

If I were in the same tax bracket as our base case person, I would lose 20% of $1,150, or $230 vs the $460 paid by the working schlep. Except the working schlep also loses CPP/EI off that sum which I do not.

That's a really sweet deal I get.

But that's not the 1/2 of it.

When I trade from within my tax-sheltered accounts, I pay zero tax.

Most low income earners have no RRSP or can afford to put very little into one.

Moreover, If I accrue a loss in a completely unrelated trade, including the sale of real property, I can reduce by taxable gain dollar for dollar.

I also get to decide whether or when to realize that loss to my maximum advantage.

Even more, if that gain is on my principle residence I needn't pay any tax at all! Woot!

I think its odd to describe a desire that the government be even-handed and agnostic on taxes (we don't care how you make your money, just give us our share) as asset-envy.

The Royal Commission on Taxation, more than 50 years ago, recommended that capital gains be taxed like any other income.

Their conclusion used this phrase "A buck is a buck is a buck"

A good summary can be found here:

The Commission above considered this and suggested that Estate level sums could be averaged over 5 years.

if you drill down, that many people who propose that all income, whether it be earned, interest, dividends or capital gains, treated the same, really don't. They simply want income that they don't have but others do, or deductions that others get but they don't, changed. axed more heavily. when the topics of RSPs, tuition and other adjustments are raised.

There is also the concern about investment capital leaving the country. I realize we are a small player in the big world, and the individual investor even smaller, but start-ups, mine exploration, etc. all need investors to have confidence in the project and the country and our individual little tax sheltered accounts are part of that.

Maybe it would be easier and more equitable if it was all treated the same. My dad was an accountant and a keeper of records. When we were cleaning out his place after he passed, I found income tax returns dating back to the 1940s. I kept the one for the year of my birth just for giggles and the entire return, including the tax table, was four pages. Now I pay somebody to do mine.

Is there anywhere in the Americas doing that?The government deducts at source, and sends you a notice of anything owing or being returned once a year, and you can dispute/correct as required. The notion of filing a tax return is utterly antiquated.